All Categories

Featured

Table of Contents

The payments that would have otherwise mosted likely to a banking organization are repaid to your personal swimming pool that would have been made use of. The result? Even more cash enters into your system, and each dollar is doing numerous work. Recapturing rate of interest and minimizing the tax obligation worry is a terrific story. It obtains also better.

This money can be used tax-free. You have full access to your funds whenever and for whatever you desire, without any costs, penalties, evaluation boards, or added security. The money you use can be repaid at your recreation with no collection settlement routine. And, when the moment comes, you can hand down whatever you have actually built up to those you enjoy and respect totally.

This is how households hand down systems of riches that enable the next generation to follow their dreams, start organizations, and benefit from chances without shedding it all to estate and inheritance taxes. Firms and banking establishments use this method to create working pools of capital for their services.

What is the minimum commitment for Self-financing With Life Insurance?

Walt Disney used this method to begin his dream of developing a theme park for youngsters. We 'd like to share extra examples. The concern is, what do want? Satisfaction? Financial safety? A sound monetary solution that doesn't rely on a varying market? To have cash money for emergency situations and possibilities? To have something to pass on to individuals you enjoy? Are you ready to learn even more? Financial Preparation Has Failed.

Sign up with one of our webinars, or go to an IBC bootcamp, all at no cost. At no charge to you, we will certainly show you extra concerning just how IBC functions, and produce with you a plan that works to fix your issue. There is no obligation at any kind of factor in the process.

This is life. This is tradition.

It appears like the name of this concept adjustments when a month. You may have heard it referred to as a continuous wide range method, family members financial, or circle of riches. No issue what name it's called, boundless financial is pitched as a secret means to construct wealth that just abundant individuals find out about.

What are the risks of using Infinite Banking For Retirement?

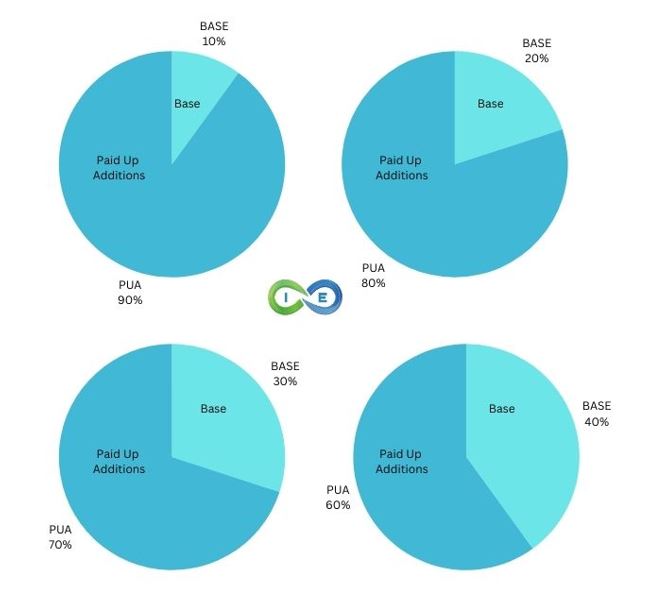

You, the insurance policy holder, placed money into an entire life insurance coverage plan with paying premiums and buying paid-up additions.

The entire concept of "banking on yourself" only works because you can "financial institution" on yourself by taking loans from the policy (the arrowhead in the chart over going from whole life insurance coverage back to the insurance holder). There are two various sorts of finances the insurance coverage firm might use, either straight acknowledgment or non-direct recognition.

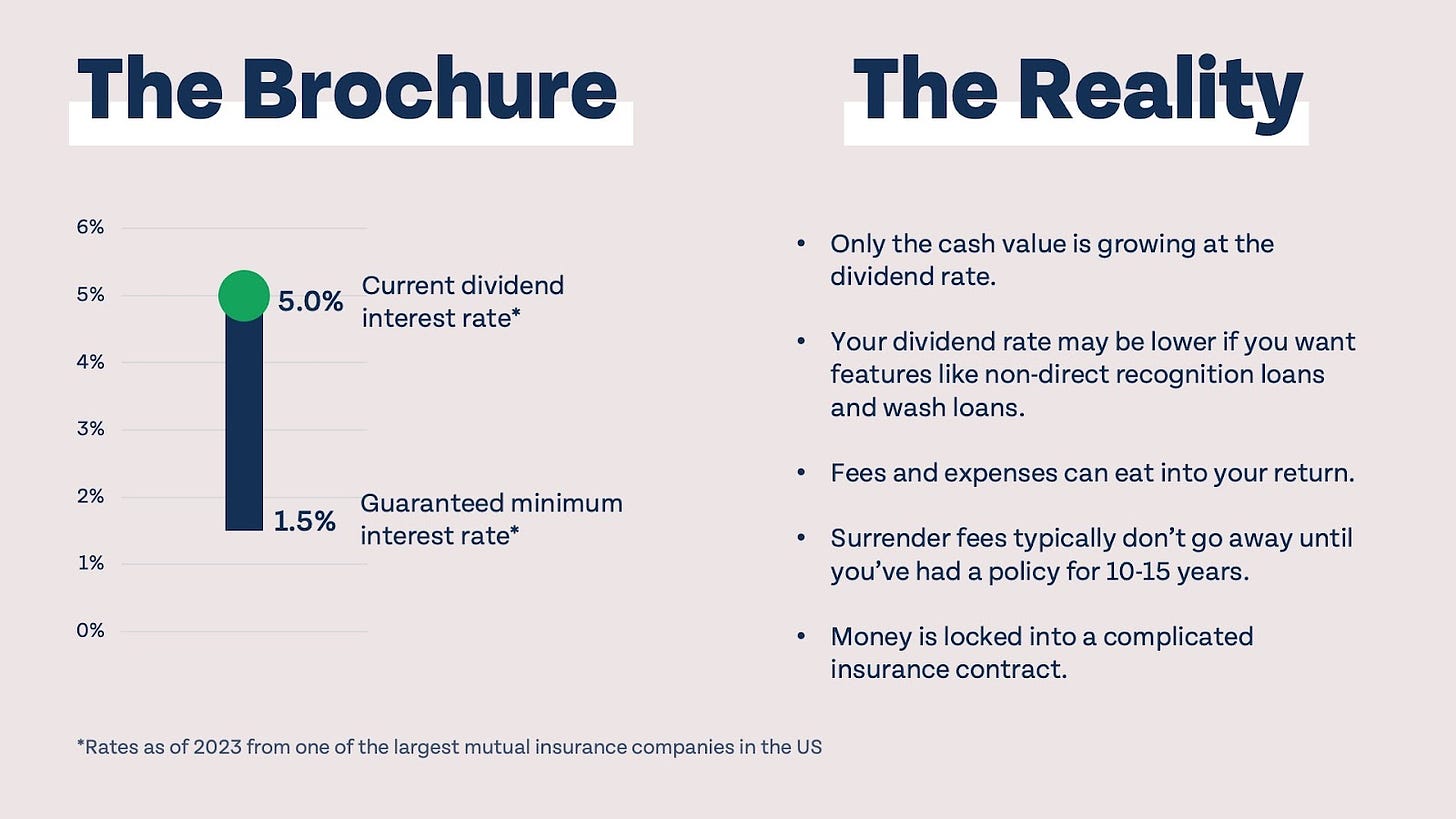

One feature called "laundry loans" sets the rates of interest on finances to the very same rate as the reward price. This implies you can borrow from the policy without paying rate of interest or receiving interest on the quantity you borrow. The draw of limitless financial is a reward rate of interest and ensured minimum rate of return.

The downsides of unlimited financial are frequently forgotten or not pointed out in any way (much of the information readily available about this principle is from insurance coverage agents, which might be a little prejudiced). Only the cash worth is expanding at the returns price. You also need to spend for the price of insurance policy, fees, and costs.

Can Wealth Management With Infinite Banking protect me in an economic downturn?

Every irreversible life insurance plan is various, yet it's clear somebody's total return on every buck spent on an insurance item might not be anywhere close to the reward price for the policy.

To provide a very fundamental and hypothetical example, allow's think a person is able to earn 3%, typically, for every buck they spend on an "limitless financial" insurance coverage product (nevertheless expenses and fees). This is double the approximated return of whole life insurance from Consumer Information of 1.5%. If we think those bucks would undergo 50% in taxes amount to if not in the insurance item, the tax-adjusted price of return can be 4.5%.

We presume greater than average returns on the whole life item and an extremely high tax rate on dollars not put right into the policy (which makes the insurance item look much better). The reality for lots of folks might be even worse. This fades in contrast to the lasting return of the S&P 500 of over 10%.

Is Life Insurance Loans a good strategy for generational wealth?

Infinite financial is a great product for agents that market insurance policy, yet may not be ideal when compared to the cheaper choices (without sales individuals making fat payments). Below's a break down of a few of the various other supposed benefits of limitless financial and why they might not be all they're fractured up to be.

At the end of the day you are buying an insurance item. We enjoy the defense that insurance policy provides, which can be gotten a lot less expensively from an inexpensive term life insurance policy. Overdue car loans from the plan may likewise reduce your death benefit, decreasing an additional degree of security in the policy.

The principle just works when you not only pay the significant premiums, yet make use of extra money to purchase paid-up enhancements. The opportunity price of all of those bucks is significant exceptionally so when you can instead be investing in a Roth IRA, HSA, or 401(k). Also when contrasted to a taxed investment account or even a financial savings account, boundless financial may not provide comparable returns (compared to spending) and comparable liquidity, accessibility, and low/no cost structure (contrasted to a high-yield savings account).

In fact, many individuals have never ever come across Infinite Financial. Yet we're below to alter that. Infinite Banking is a method to handle your cash in which you produce a personal bank that works similar to a normal bank. What does that indicate? Well, we stated that standard financial institutions are used for storage space facilities and funding.

How do I optimize my cash flow with Generational Wealth With Infinite Banking?

Just placed, you're doing the banking, however rather of depending on the conventional bank, you have your very own system and complete control.

In today's article, we'll reveal you four various ways to use Infinite Banking in service. We'll review 6 ways you can use Infinite Financial directly.

Latest Posts

Whole Life Insurance-be Your Own Bank : R/personalfinance

Ibc Private Bank

Ibc Concept